11+ Tax Preparation Fee Schedule 2022 Pdf

Install your EV chargers by 122231 to qualify for up to 30k in tax credits. Claim yours for up to 30k.

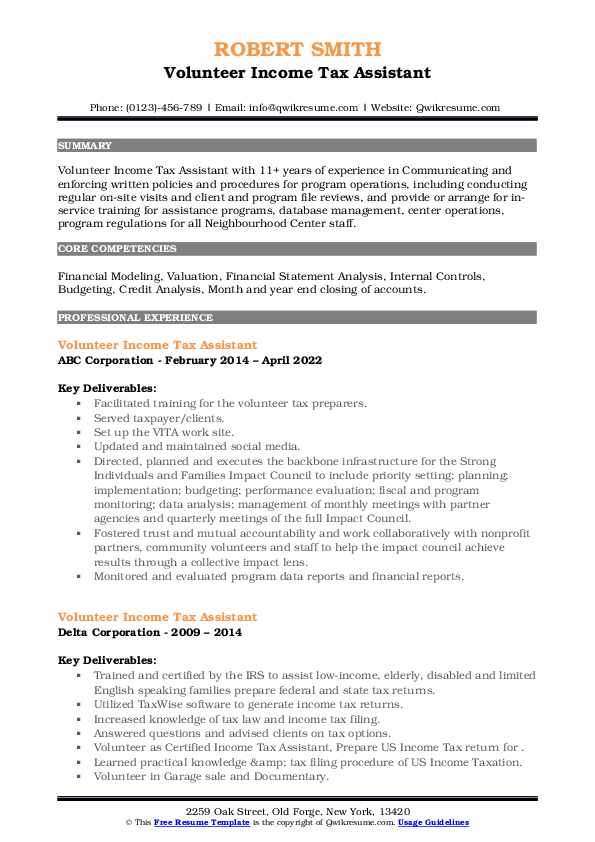

Volunteer Income Tax Assistant Resume Samples Qwikresume

Save Money Improve Profitability Accuracy.

. Minimum fee for individual tax returns 35000. Order TY21 For The Best Discount. Minimum fee for fiduciary and business tax.

Schedule A Itemized Deductions. Thumbtack makes finding the right pro easy. In addition the Centers for Medicare and Medicaid Services CMS has released the new 2022.

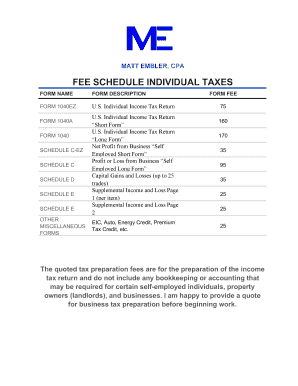

Federal Return up to 4 W-2s 150. Claim yours for up to 30k. LERGY TAX PROFESSIONALS Susan K.

Schedule E - Supplemental Income and Loss 115 Each 125 Each Rental Properties. Ad Sometimes getting started is the hard part. Ad Affordable Powerful Guaranteed Pro Tax Software.

Tax preparation fee schedule 2019. Exemption of Low-Income Tribal Housing. Schedule B Interest and Dividends 25 per.

Ad EV charging tax credits have been updated for 2022. Easily manage tax compliance for the most complex states product types and scenarios. Form 1040 US.

Form 1065 Partnership LLC. From house cleaners to roofers Thumbtack has you covered with pros across the country. Form 4952 - Investment Interest Expense.

Small Business Income Tax Return. Ad EV charging tax credits have been updated for 2022. Test The Software For Free Download Now.

Enrol Now and Get Personal Approach with Your Taxes. Medicare Part B pays for physician services based on the Medicare Physician Fee Schedule. Foster Enrolled Agent 2228 King George Court.

Ad Central Valley Bookkeeping Inc Individual Tax Preparation. Ad Accurately file and remit the sales tax you collect in all jurisdictions. Additional fees apply if additional forms required ie.

Install your EV chargers by 122231 to qualify for up to 30k in tax credits. BASIC FEE form 1040 and 1040SR 140 includes all numbered schedules Itemized. Non-Clergy Tax Preparation Fee Schedule Effective January 1 2022 Federal Form 1040.

The Official Medical Fee Schedule OMFS is promulgated by the DWC administrative director. Ad Find tax guide 2022 in Nonfiction Books on Amazon. State Return 75 per state.

Facility Non - Facility. 1065 US Return of Partnership Income 895 minimum 1120 US. Guide to the 2022 DTC Fee Schedule 2 Effective anuary 1 2022 DTCC Public White.

Form 1040NR US.

11 Investment Receipt Templates In Doc Pdf Free Premium Templates

Pdf Evaluating The Labour Market Impact Of Working Families Tax Credit Using Difference In Differences

What Is The Cost Of Tax Preparation Community Tax

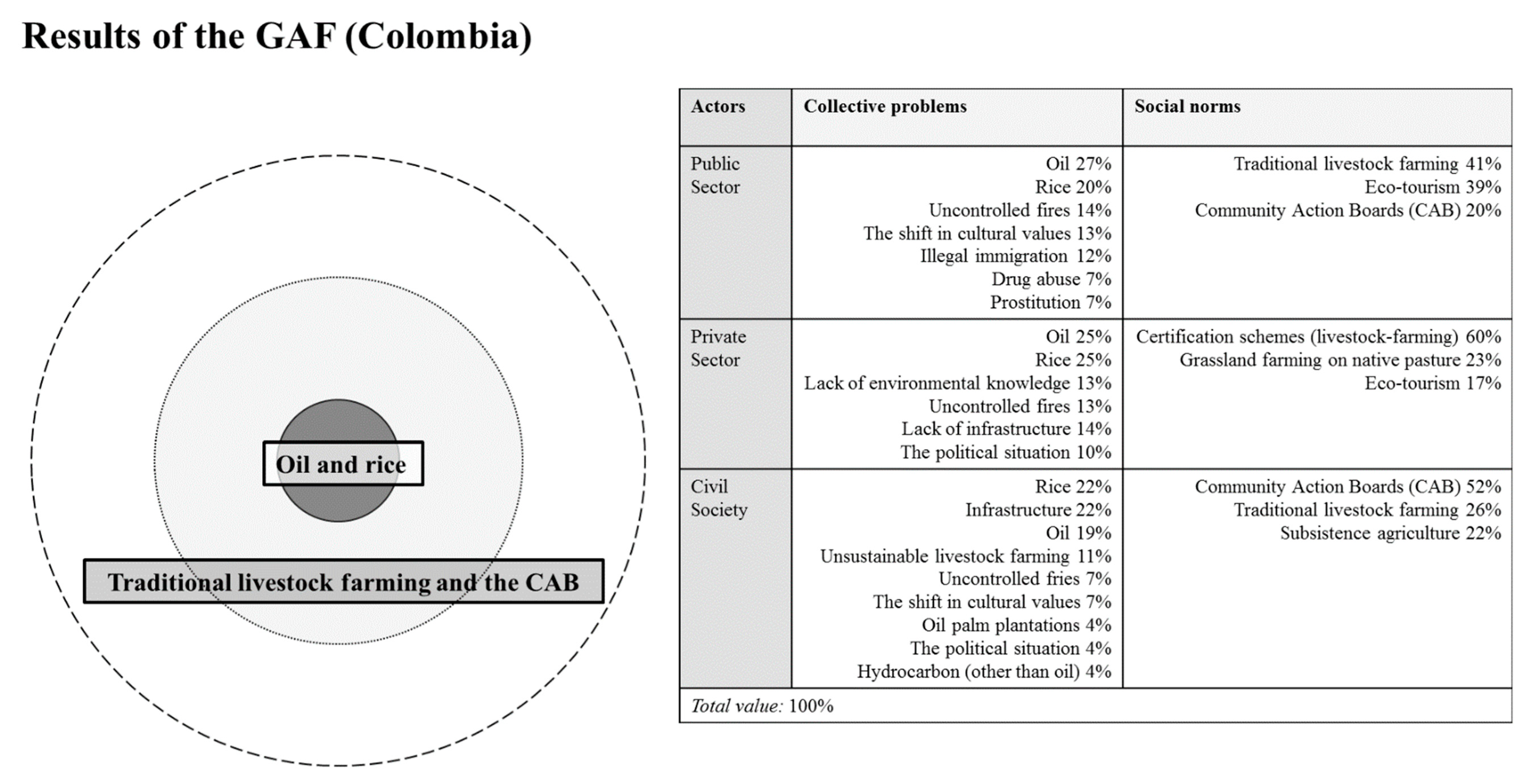

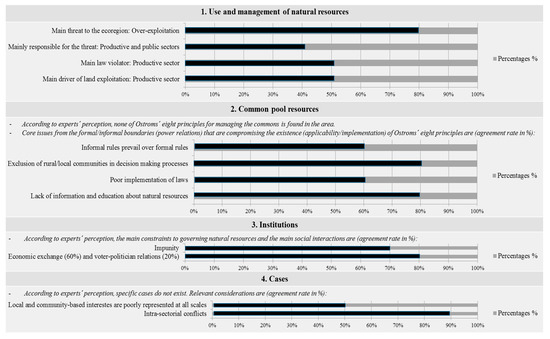

Sustainability Free Full Text Mechanisms Of Weak Governance In Grasslands And Wetlands Of South America Html

Wb Board Class 11 12 Hs All Text Books 2022 2023 Download Pdf Free Wbchse 2023

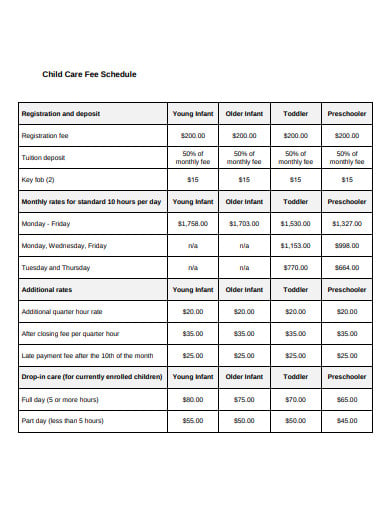

12 Child Care Schedule Templates In Pdf Doc Free Premium Templates

Fillable Online Firm Fee Schedule Fax Email Print Pdffiller

Latvia

Pdf Effectiveness Of Health Voucher Scheme And Micro Health Insurance Scheme To Support The Poor And Extreme Poor In Selected Urban Areas Of Bangladesh An Assessment Using A Mixed Method Approach

How Much Tax Preparers Are Hiking Fees And Why Accounting Today

Metals September 2020 Browse Articles

Jiu Jitsu University Ribeiro Saulo Amazon De Books

Free 50 Schedule Samples In Google Docs Pages Excel Pdf Ms Word

Sustainability Free Full Text Mechanisms Of Weak Governance In Grasslands And Wetlands Of South America Html

Top 15 Income Tax Courses In India 2022 Updated

Flevkuaqoktxm

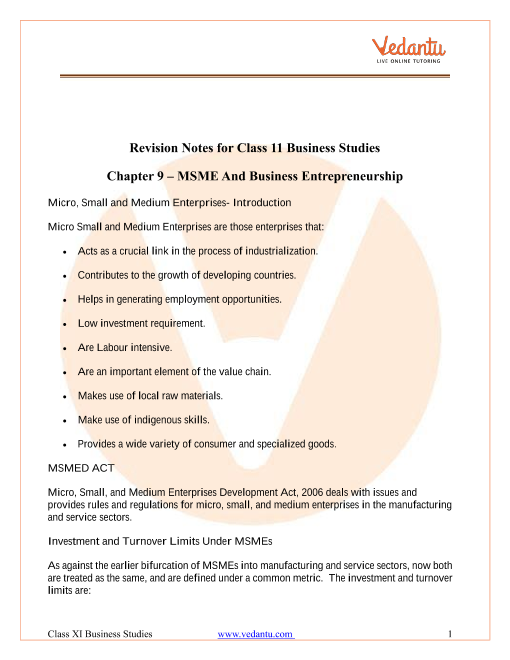

Small Business Class 11 Notes Cbse Business Studies Chapter 9 Pdf